does wyoming charge sales tax on labor

Wyoming also does not have a corporate income tax. Wyoming has a destination-based sales tax system so you have to pay.

Does Rhode Island Charge Sales Tax On Labor

Groceries and prescription drugs are exempt from the Wyoming sales tax.

. State wide sales tax is 4. Wyoming does not have a sales tax holiday. Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area.

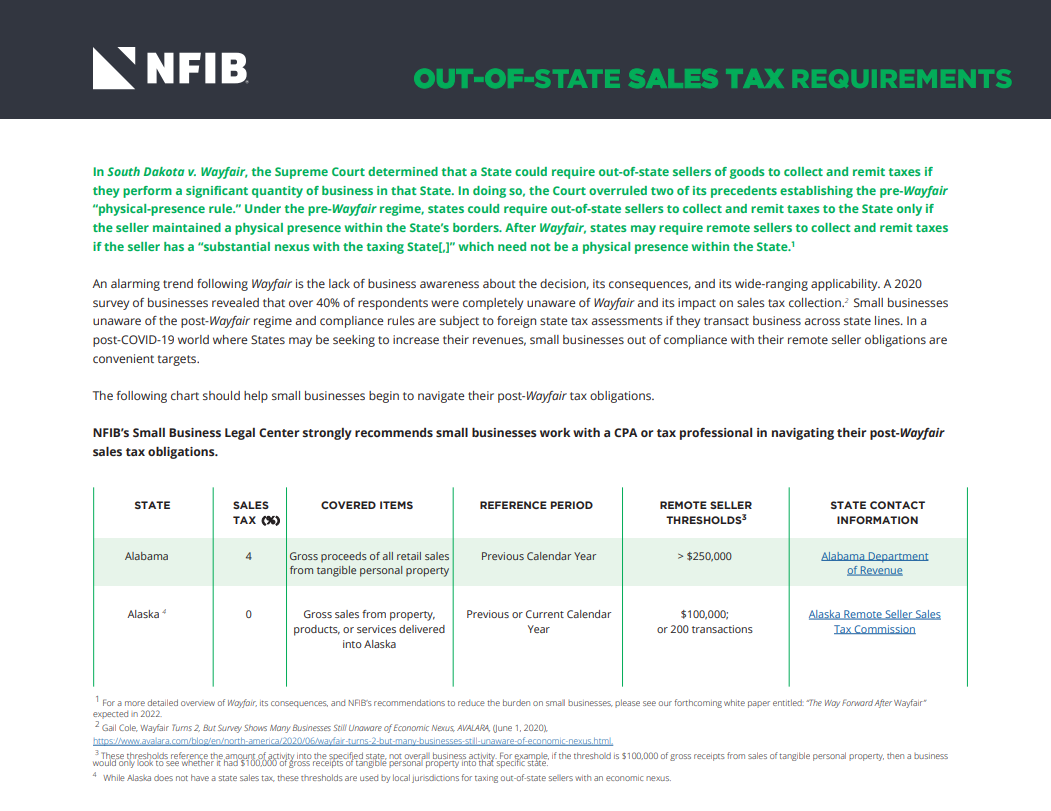

The Excise Division is comprised of two functional sections. The taxability of various transactions like services and shipping can vary from state to state as do policies on subjects such as whether excise taxes or installation fees included in the. The Wyoming Department of Revenue has issued a news bulletin regarding the taxability of professional services.

Labor unions and workers organizations are exempt from taxation on dues and other forms of income. It is also the same if you will use Amazon FBA there. Heres an example of what this scenario looks like.

This page describes the taxability of. Counties and cities can charge an additional local sales tax of up to 2. No you do not pay sales tax on labor.

In Wyoming specified services are taxable. Services refers to the sale of labor or a non-tangible benefit. Wyoming does not have an individual income tax.

Groceries and prescription drugs are exempt from the Indiana sales tax. In Wyoming when do you have to charge sales tax. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

Services are subject to sales tax in a number of states. Remote sellers and marketplace facilitators must collect sales tax from retail sales into Wyoming if they meet the. We advise you to check out the Wyoming.

Mary owns and manages a bookstore in Cheyenne Wyoming. Does Wyoming have property tax. In different states the term sales tax.

On top of the state sales tax there may be one or more local sales taxes as well as one or. Businesses licensed under the Wyoming sales tax laws must report use tax on their sales tax return forms ETS Form 41-1 or 42-1 and 42-2. You can look up the local sales tax rate.

The state sales tax rate in Wyoming is 4. The state-wide sales tax in Wyoming is 4. In addition Local and optional taxes can be assessed.

Remote and marketplace sellers. Wyoming Use Tax and You. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200.

While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. This is the same whether you live in Wyoming or not. Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4.

Does minnesota charge sales tax on labor. Since books are taxable in the state of Wyoming Mary. Wyoming sales tax rate is 4 and the maximum WY sales tax after local surtaxes is 7.

There are additional levels of sales tax at local jurisdictions too. If your business has a sales tax nexus in Wyoming you must charge sales tax. Personal and real property.

Contractors must report their use tax on forms. The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7.

Sales Tax Laws By State Ultimate Guide For Business Owners

Do Construction Companies Need To Pay Sales Tax

How Racial And Ethnic Biases Are Baked Into The U S Tax System

How To Charge Your Customers The Correct Sales Tax Rates

Understanding General Sales And Use Tax In Wyoming Youtube

State And Local Sales Tax Rates Midyear 2022

Do Construction Companies Need To Pay Sales Tax

Sales Taxes In The United States Wikipedia

A Complete Guide To Wyoming Payroll Taxes

2022 2023 Michigan Labor Law Poster State Federal Osha In One Single Laminated Poster

What Transactions Are Subject To The Sales Tax In Arizona

Tax Prep Overview Out Of State Sales Tax For Small Business

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

What Transactions Are Subject To The Sales Tax In California

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation